MI FOC 115 2011-2026 free printable template

Show details

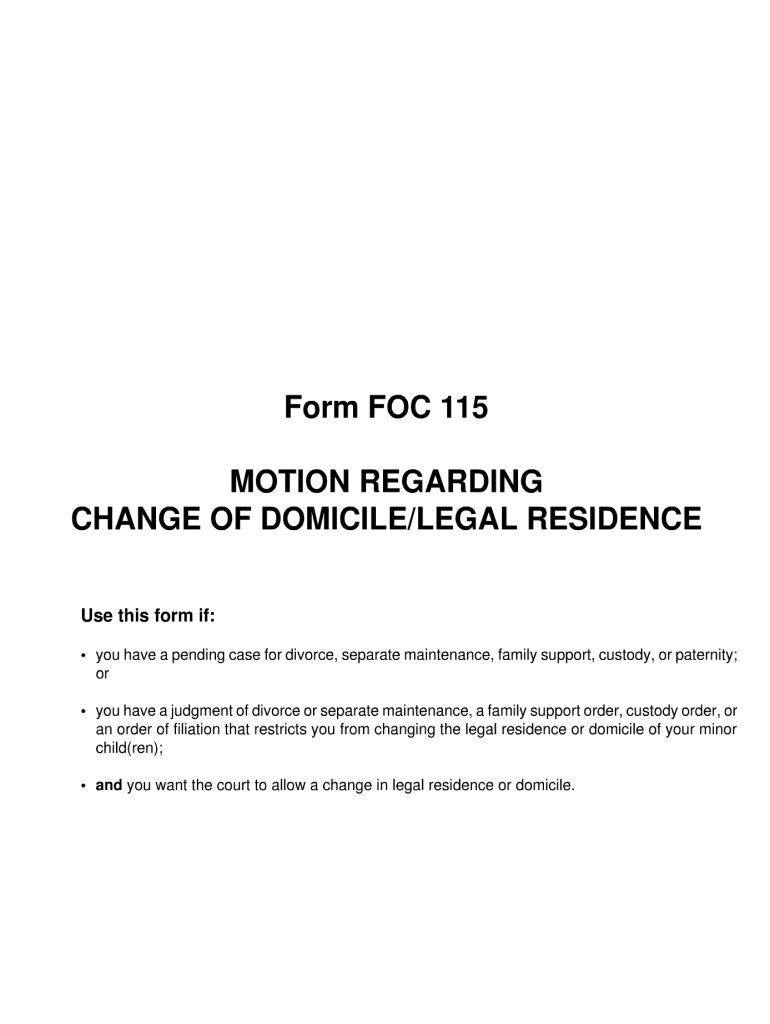

Form FOC 115 MOTION REGARDING CHANGE OF DOMICILE/LEGAL RESIDENCE Use this form if: you have a pending case for divorce, separate maintenance, family support, custody, or paternity; or you have a judgment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign domicile change form

Edit your form foc domicile form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan foc 115 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit michigan domicile online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit foc 115 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out MI FOC 115

How to fill out MI FOC 115

01

Obtain the MI FOC 115 form from the appropriate website or office.

02

Read the instructions accompanying the form carefully.

03

Fill out the personal information section, including your name, address, and contact information.

04

Complete the sections relevant to your situation, providing accurate and detailed information.

05

Review the information for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form according to the instructions (mail, online submission, etc.).

08

Keep a copy of the submitted form for your records.

Who needs MI FOC 115?

01

Individuals seeking assistance with family law matters.

02

People required to provide financial information for court cases.

03

Applicants for certain government assistance programs.

04

Those involved in child custody or support evaluations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a PS form 3575?

Fill out and submit PS Form 3575, available at any U.S. Post Office.

Can I get a PS form 3575 online?

A Change of Address (COA) request can be temporary or permanent. Both options can be requested and completed online or by filling out a PS Form 3575 acquired from your local Post Office™. The PS Form 3575 form can no longer be printed from your home computer.

How do I get a form to change my address with USPS?

Visit your local Post Office location with an acceptable photo ID. Request a free Mover's Guide packet. Fill out the PS Form 3575 found inside the packet.

Can you print a change of address form?

Change of Address Options A Change of Address (COA) request can be temporary or permanent. Both options can be requested and completed online or by filling out a PS Form 3575 acquired from your local Post Office™. The PS Form 3575 form can no longer be printed from your home computer.

Does it cost $100 to change your address?

If you just wish to file with the US Postal Service and not receive our additional benefits, you may do so by visiting the USPS® website. There is a one dollar processing fee charged by the USPS® for submitting an online address change request that must be paid with a valid debit or credit card.

What documents do I need to change my drivers license in Tennessee?

Present Required Documents Your current license or certified copy of driving record or other acceptable ID. Proof of U.S. Citizenship, Lawful Permanent Resident Status or Proof of authorized stay or temporary legal presence in the United States.

What do I need to change my address on my driver's license in Tennessee?

To update your record with your new address by mail, you will need to provide the following information: Full name. Date of birth. Driver License Number. Social Security Number. Old address that appears on current driver license. New address. County of your new address.

Why did it cost $100 to change my address?

The USPS will never charge you $80 to change your address. It costs just $1.10 if you choose to do it online. If you've been charged more than that in the process of changing your address, you've likely paid a third-party website unaffiliated with the Postal Service.

Is change of address faster online or in person?

Fees to change your address MethodForms neededTakes effectOnlineOfficial USPS Change of Address form7–10 postal business days after start dateIn personMover's Guide (available in lobby)7–10 postal business days after start date Aug 4, 2022

How do I forward my mail when someone moves?

Put the phrase “Forward to:” above the name on the envelope first, and then write the address. Keep your writing neat and legible so your mail carrier can read it. Do not change the name or return address in the upper left corner of the piece of mail.

How do I stop mail from going to my old address?

Please visit your local Post Office™ location and complete Form PS Form 8076, Authorization to USPS Hold Mail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MI FOC 115 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign MI FOC 115 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for signing my MI FOC 115 in Gmail?

Create your eSignature using pdfFiller and then eSign your MI FOC 115 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit MI FOC 115 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share MI FOC 115 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MI FOC 115?

MI FOC 115 is a form used in Michigan for reporting information related to domestic relations and child support enforcement.

Who is required to file MI FOC 115?

Individuals who are involved in a child support case, either as custodial or non-custodial parents, are required to file MI FOC 115.

How to fill out MI FOC 115?

To fill out MI FOC 115, complete the required sections with accurate personal and case information, ensuring all relevant details about income and assets are disclosed.

What is the purpose of MI FOC 115?

The purpose of MI FOC 115 is to provide the court with necessary financial information for determining child support obligations.

What information must be reported on MI FOC 115?

MI FOC 115 requires reporting of personal identification details, income, employment information, and any other financial resources relevant to the child support case.

Fill out your MI FOC 115 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI FOC 115 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.